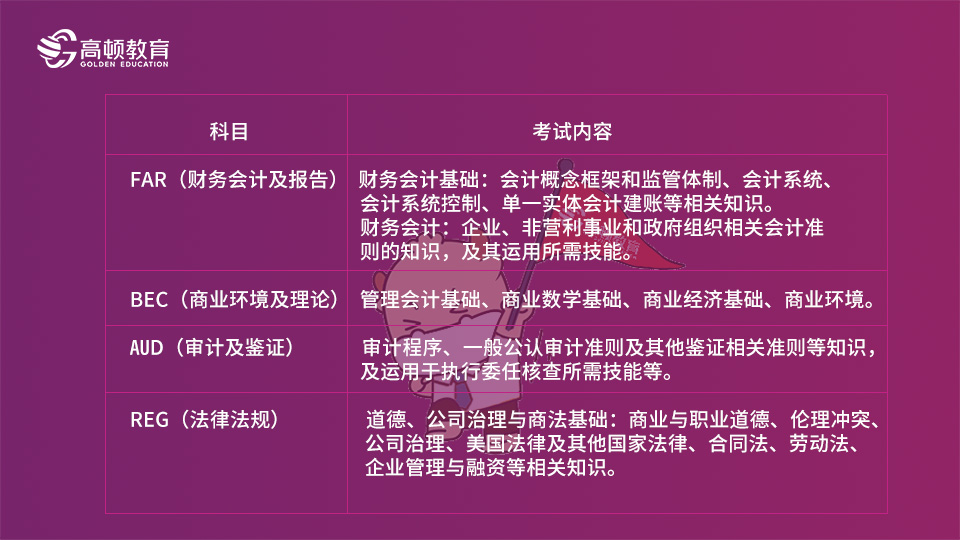

对自学的考生来说,听辅导课是必不可少的,在网课老师的指导下,学员自己去精读钻研,才能加深对USCPA知识的理解,牢固掌握应考知识。

体验免费课程>> Overview概述:

A certified public accountant (CPA) in today's environment must not only have a high level of technical competence and a sense of commitment to service, but must also have good communications and analytical skills, and the ability to work well with people. Employers are looking for individuals who have the ability to analyze and *uate complex business problems and the interpersonal skills and maturity to make decisions in a client- and customer-service environment.

To obtain the required body of knowledge and to develop the skills and abilities needed to be successful CPAs, students should complete 150 semester hours of education. Many states/jurisdictions now require or will require 150 semester hours of education for obtaining the CPA certification. Colleges and universities in these states/jurisdictions determine the curriculum for pre-licensure education of CPAs; it typically features a good balance of accounting, business, and general education.

Why an Emphasis on 150 Semester Hours of Education for Aspiring CPAs?

为什么强调150个学分获得USCPA证书更励志?

There are a number of reasons why a traditional four-year undergraduate program is no longer adequate for obtaining the requisite knowledge and skills to become a CPA:

Significant increases in official accounting and auditing pronouncements and the proliferation of new tax laws have expanded the knowledge base that professional practice in accounting requires.

Business methods have become increasingly complex. The proliferation of regulations from federal, state, and local governments requires well-educated individuals to ensure compliance. Also, improvements in technology have had a major effect on information systems design, internal control procedures, and auditing methods.

The staffing needs of accounting firms and other employers of CPAs are changing rapidly. With more sophisticated approaches to auditing now in use, and with the increase in business demands for a variety of highly technical accounting services and greater audit efficiency, the requirements for effective professional practice have increased sharply. The demand for a large quantity of people to perform many routine auditing tasks is rapidly diminishing.

How to Meet the 150-Hour Requirement

怎样满足150学分的要求:

Many colleges and universities offer bachelor's and master's degree programs in accounting. To obtain 150 semester hours of education, students do not necessarily have to get a master's degree. They can meet the requirement at the undergraduate level or get a bachelor's degree and take some courses at the graduate level. Students can also choose any of the following:

Combine an undergraduate accounting degree with a master's degree at the same school or at a different one;

Combine an undergraduate degree in some other discipline with a master's in accounting or an MBA with a concentration in accounting;

Enroll in an integrated five-year professional accounting school or program leading to a master's degree in accounting.

In most cases, the additional academic work needed to acquire the technical competence and develop the skills required by today's CPA is best obtained at the graduate level. Graduate-level programs are an excellent way to more fully develop skills such as communication, presentation, and interpersonal relations, and to integrate them with the technical knowledge being acquired.

For these reasons, leading professional organizations such as the AICPA, the National Association of State Boards of Accountancy, and the Federation of Schools of Accountancy have consistently supported the 150-hour education requirement for entry into the accounting profession.

高顿网校小编为您介绍美国景点:好莱坞

好莱坞(Hollywood),本意上是一个地名的概念,港译“荷里活”,是全球最著名的影视娱乐和旅游热门地点,位于美国加利福尼亚州洛杉矶市市区西北郊。现“好莱坞”一词往往直接用来指美国加州南部的电影工业。好莱坞市位于加利福尼亚州西南部的美国第二大城市洛杉矶市的西北部,是世界著名的电影城市。

-

关注公众号

报考咨询 专业师资

考前资料下载

- 赞118

-

版权声明:

1、凡本网站注明“来源高顿教育”或“来源高顿网校”或“来源高顿”,的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

2、经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿网校”或“来源高顿”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

3、本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

4、如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

精彩推荐相关问题

-

AICPA 证书是美国注册会计师协会旗下的专业资格认证,是美国正式的国家资格认证。AICPA证书具有非常高的含金量和认可度,在世界财会领域具有一定的地...

2022-07-19

-

USCPA 考试是美国注册会计师考试,在美国持有USCPA证书能够获得很高的社会地位以及公众信任度,在国内的很多公司也需要USCPA持证的人才,尤其是在美资企...

2022-07-12

-

AICPA 考试是美国注册会计师考试,AICPA证书在美国具有审计签字权,并且在全世界获得了广泛的认可,具有很高的含金量,是国际财会领域的三大黄金证书...

2022-07-07

-

在激烈的就业竞争下,具有一个高含量的证书才能够在行业之中占据一定的地位,而 USCPA 证书就是一个很好证明持证人能力的凭证。USCPA证书的认可度比较...

2024-04-28

-

USCPA 证书在国际财会领域的认可度很高,许多国际化的大企业和行业内的专业人士都会非常认可USCPA证书。近年来,随着经济全球化的发展,国内财会人士...

2022-07-06

-

USCPA 考试是美国注册会计师考试的简称,美国注册会计师在美国享有审计签字权,在国际财会领域具有很大的影响力,多个国家和地区都非常认可USCPA证书...

2022-07-06

-

USCPA 美国注册会计师考试相对于国内的注册会计师考试来说,考试的难度会降低,但是还是有一定的难度的。因为USCPA考试采用的是全英文的考试,考点的...

2022-07-05

-

由于疫情的影响,大多数行业的发展都受到了影响,可是即使是在很多行业都已经受到影响的情况下,会计行业对于人才的需求依旧非常大,这对于会计行...

2022-07-04

-

在疫情常态化的当下,会计行业在经济发展的过程中起到了重要的作用,即使在多个行业收到影响的情况下,会计行业的需求量依旧非常大,这对于各位来...

2022-07-04

-

AICPA 考试指的是美国注册会计师考试,AICPA证书在美国拥有审计签字权,是美国正式的会计师国家资格认证,在世界财会领域获得了专业人士以及企业的广...

2022-06-22

63题E选项为何不选啊!持有公司发行股份5%前五名股东单位任职人员不能担任,10%已经大于5%不是应该能担任吗?如果不能担任,范围是多少

老师:可以分别和我说一下: 1.非货币性资产交换:双方的入账价值和差额怎么确认吗 2.债务重组的:双方入账价值和差额分别怎么确认 3.长期股权投资:初始投资成本,初始入账价值 这几个概念经常弄晕

63题E选项为何不选啊!持有公司发行股份5%前五名股东单位任职人员不能担任,10%已经大于5%不是应该能担任吗?如果不能担任,范围是多少

老师:可以分别和我说一下: 1.非货币性资产交换:双方的入账价值和差额怎么确认吗 2.债务重组的:双方入账价值和差额分别怎么确认 3.长期股权投资:初始投资成本,初始入账价值 这几个概念经常弄晕

QQ登录

QQ登录 微博登录

微博登录 微信登录

微信登录