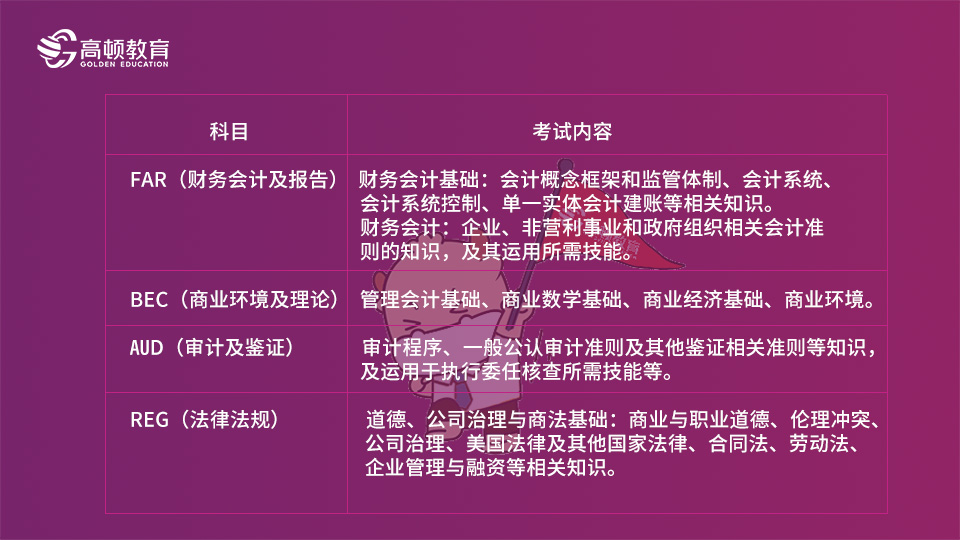

USCPA考试中,很多人认为FAR比较难,因为考察的知识点很多。不过它的逻辑性还是很强的,所以把知识点融会贯通来记忆,会轻松很多。今天高顿网校小编要介绍的知识点就是FAR中的常考内容:贷款。

之前介绍了票据和债券的计算,今天就来讲讲贷款。和票据和债券不一样,贷款一般情况下没有coupon rate 和effective rate 的区分(除非出现compensating balance, discounted loan 等特殊情形,这些特殊的情况会在BEC 里涉及)。

所以,除非贷款协议中出现诸如compensating balance,discounted loan 或者lines of credit with commitment fees 等特殊条款(这些情况会导致effective rate 和contractual rate 不一致),一般情况下,因为在贷款协议签订时,银行会根据客户的抵押品、信用状况和财务状况评估风险并专门就该贷款设定一个协议利率,所以contractual rate 等于effective rate。实际的利息费用一般情况下就等同于企业的融资成本。但是,存在loan origination fee 的情况下就不是这样了。

Loan origination fee 的定义其实是这样的:Loan origination refers to the initiation and completion of the home loan process, which begins when a borrower submits their financial information to a bank or mortgage lender for loan processing.它包括了attorney’s fee(律师费), title insurance 和人工费。

银行贷款的手续费(loan origination fee)与债券的发行成本issuance cost 的在计算贷款起始carrying value 时处理方法略有所不同。贷款手续费可以是direct 的,也可以是indirect 的;可能是borrower 承担的,也可能是银行承担的。相应的会计处理如下表:

| Origination fee type | Carrying amount of loan |

| On borrower’s book | On lender’s book |

| Direct origination fee charged to borrower | Deducted from principal | Deducted from principal |

| Direct origination fee incurred by lender | N/A | Added to principal |

| Indirect origination fee | 当期expense | |

接下来我们来看一道例题。

Example:

Assume that Bannon Bank grants a ten-year loan to VerSteiner, Inc. in the amount of $100,000 with a stated interest rate of 8%. Payments are due monthly, and are computed to be $1,213. In addition, Bannon Bank incurs $3,000 of direct loan origination costs, and also charges VerSteiner a 5-point nonrefundable loan origination fee. Calculate the beginning balance of loan receivable and loan payable for Bannon Bank and VerSsteiner, Inc.

解析:

计算经loan origination fee 调整后的贷款期初余额,需要先从borrower 的贷款期初余额开始算起。Borrower 的期初余额等于贷款本金-direct origination fee incurred by borrower,所以是$100,000-$100,000*5%=$95,000. 所以borrower 的贷款期初余额是$95,000. 对于lender 来说,贷款期初余额=本金-direct origination fee incurred by borrower + direct origination fee incurred by borrower. 所以,贷款本金额是$95,000+$3,000=$98,000.

高顿财经USCPA研究院Karen老师指出,在这里需要注意borrower 和lender 的贷款期初余额计算的差异比较:

Borrower: principal - borrower incurred origination fee

Lender: principal - borrower incurred origination fee + lender incurred origination fee

计算出新的loan carrying amount 之后,需要再根据这个carrying amount 倒算出effective rate。可以发现,borrower 的effective rate 和lender 的effective rate 可能是不一样的。同理,产生的discount 和premium 在后续期间也需要按照effective rate method 进行摊销。

▎申明:本文由Lynn汇集整理,系高顿网校编辑团队汇编作品,转载请注明作者及出处。更多内容请关注微信号“高顿AICPA”(gaodunaicpa),让我们一起学习AICPA,了解美国文化,获取*7信息。