1、凡本网站注明“来源高顿教育”或“来源高顿网校”或“来源高顿”,的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

2、经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿网校”或“来源高顿”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

3、本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

4、如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

获得证书可以为考生开辟更广阔的职业发展道路,并有望带来薪资水平的提升。随着经济全球化的快速发展,各企业对于uscpa这类人才的需求也与日俱增,...

2024-04-03考取证书可以帮助大家拓宽职业发展渠道、提高薪资待遇,随着经济全球化的快速发展,各企业对于uscpa这类人才的需求也与日俱增,美国注会也渐渐成为...

2024-04-01财务职场竞争激烈,要想脱颖而出就需要提高自己的核心竞争力,USCPA美国注册会计师,被称为“国际通行证”,吸引了很多人报考,期望能为职位晋升方...

2024-03-13财务职场竞争激烈,要想脱颖而出就需要提高自己的核心竞争力,USCPA美国注册会计师,被称为“国际通行证”,可以豁免多个国家/地区的cpa证书,很多人...

2024-03-12uscpa是美国注册会计师的简称,被称为“国际通行证”,可以豁免多个国家/地区的cpa证书,越来越多的人开始认识到,拥有AICPA证书可以提高自己在国际财...

2024-03-01如今经济全球化发展,现代人工作压力越来越大,很多人都会选择报考证书提升自我进竞争力。uscpa是美国注册会计师的简称,引入国内市场后吸引了很多...

2024-02-23uscpa是美国注册会计师的简称,在美国拥有审计签字权,是全球化财会人才能力的象征,随着经济全球化发展,被引入国内市场,吸引了很多人报考。其中...

2024-02-21uscpa是美国注册会计师的简称,在美国拥有审计签字权,是全球化财会人才能力的象征,随着经济全球化发展,被引入国内市场,吸引了很多人报考。其中...

2024-02-20uscpa是美国注册会计师的简称,在美国拥有审计签字权,是全球化财会人才能力的象征,随着经济全球化发展,被引入国内市场,吸引了很多人报考。其中...

2024-02-20uscpa是美国注册会计师的简称,在美国拥有审计签字权,在经济全球化发展的大环境下,被引入国内市场,并且掀起了一阵报考热潮。其中,很多小伙伴都...

2024-02-1863题E选项为何不选啊!持有公司发行股份5%前五名股东单位任职人员不能担任,10%已经大于5%不是应该能担任吗?如果不能担任,范围是多少

资本公积的计算过程不理解

B为什么不对呢

老师:可以分别和我说一下: 1.非货币性资产交换:双方的入账价值和差额怎么确认吗 2.债务重组的:双方入账价值和差额分别怎么确认 3.长期股权投资:初始投资成本,初始入账价值 这几个概念经常弄晕

77题C选项不是应该1%,为什么C正确

63题E选项为何不选啊!持有公司发行股份5%前五名股东单位任职人员不能担任,10%已经大于5%不是应该能担任吗?如果不能担任,范围是多少

资本公积的计算过程不理解

B为什么不对呢

老师:可以分别和我说一下: 1.非货币性资产交换:双方的入账价值和差额怎么确认吗 2.债务重组的:双方入账价值和差额分别怎么确认 3.长期股权投资:初始投资成本,初始入账价值 这几个概念经常弄晕

77题C选项不是应该1%,为什么C正确

uscpa在美国拥有审计签字权,作为美国的专业会计师认证,在美国的地位相当于国内CPA在中国的地位,是全球化财会人才能力的象征,如今报考uscpa的同学越来越多,那么,美国cpa考试花费多吗?怎样可以节约成本?一起来看看吧。...

2023-12-13uscpa在美国拥有审计签字权,作为美国的专业会计师认证,在美国的地位相当于国内CPA在中国的地位,是全球化财会人才能力的象征,如今报考uscpa的同学越来越多,那么,美国cpa考试有什么优势?报名费贵吗?一起来看看吧。...

2023-12-13uscpa在美国拥有审计签字权,作为美国的专业会计师认证,在美国的地位相当于国内CPA在中国的地位,是全球化财会人才能力的象征,如今报考uscpa的同学越来越多,那么,美国cpa考试适合什么人考?怎么报名?一起来看看吧。...

2023-12-13uscpa在美国拥有审计签字权,作为美国的专业会计师认证,在美国的地位相当于国内CPA在中国的地位,是全球化财会人才能力的象征,那么,美国注册会计师在中国有用吗?报考要求是什么?一起来看看吧。...

2023-12-12uscpa在美国拥有审计签字权,作为美国的专业会计师认证,在美国的地位相当于国内CPA在中国的地位,是全球化财会人才能力的象征,那么,美国注册会计师在中国有用吗?该怎么报名?一起来看看吧。...

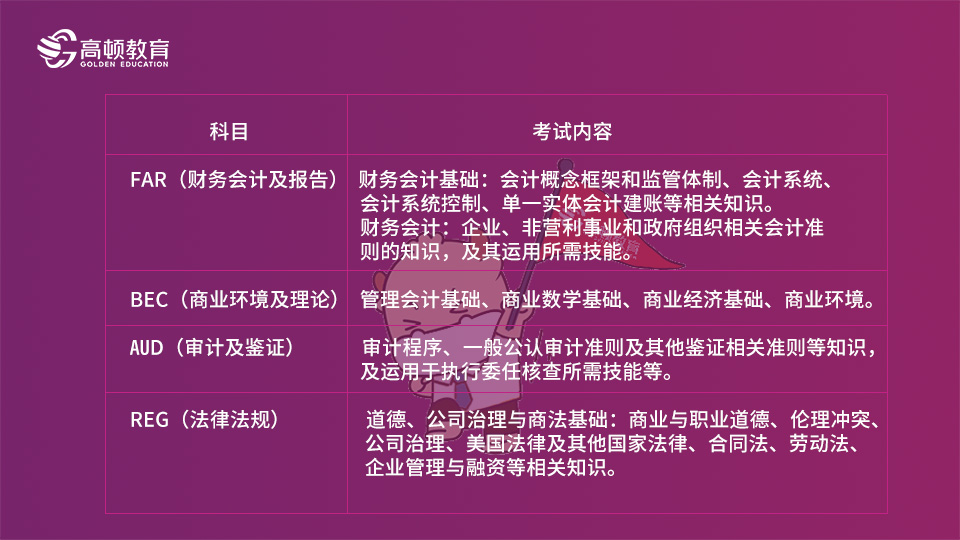

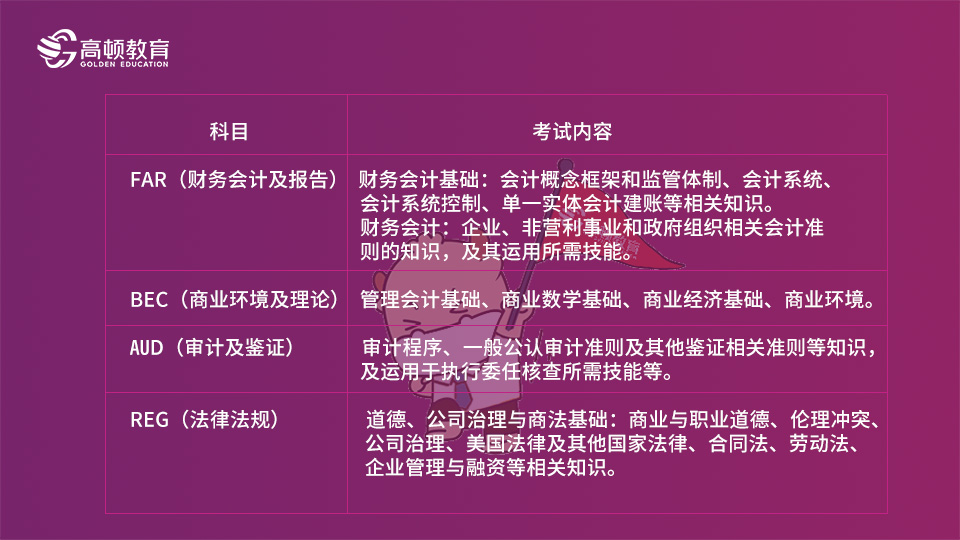

2023-12-11USCPA是美国正式的注册会计师国家资格,是执业人士能力的象征,作为全球高含金量财会类证书之一,在全世界享有广泛盛誉,aicpa被引入国内,更是引起了一阵考证热潮,那么,美国注册会计师的考试时间和科目是什么?大家一起来看看吧。...

2023-12-07USCPA是美国正式的注册会计师国家资格,是执业人士能力的象征,作为全球高含金量财会类证书之一,在全世界享有广泛盛誉,随着全球经济一体化的加速,aicpa被引入国内,引起了一阵考证热潮,那么,去美国做会计需要考什么证?报考条件是什么?大家一起来看看吧。...

2023-12-07USCPA是美国正式的注册会计师国家资格,作为全球高含金量财会类证书之一,在国际上具有很高的认可度。为了不被时代所淘汰,大家选择考取uscpa来提升自己的竞争力。那么,美国cpa报名条件要求有哪些?考了能换什么证书?大家一起来看看吧。...

2023-12-06USCPA是美国正式的注册会计师国家资格,作为全球高含金量财会类证书之一,在国际上具有很高的认可度,对于想要留学或者移民的人来说,是一个加分证照。那么,美国cpa报名条件要求是什么?大家一起来看看吧。...

2023-12-06USCPA作为全球高含金量财经证书之一,在国内外都有着巨大的人才缺口,持证人不论是从个人的职业发展前景,还是从薪酬待遇都具有极高的竞争力。吸引了很多人报考。而2023年9月NASBA考试系统更新,USCPA考试费用也跟着变化。那么,2024年aicpa考试费用有哪些?一起来看看吧。...

2023-12-01