USCPA(美国注册会计师)考试共有四门科目

:AUD(审计)、FAR(财务会计与报告)、REG(法规)、BEC(商业环境)。据说不完全统计高顿USCPA学员平均通过周期一年左右,也有三个月通过全科考试。

| 科目 |

考试内容 |

| FAR(财务会计及报告) |

财务会计基础:会计概念框架和监管体制、会计系统、会计系统控制、单一实体会计建账等相关知识。财务会计:企业、非营利事业和政府组织相关会计准则的知识,及其运用所需技能。 |

| BEC(商业环境及理论) |

管理会计基础、商业数学基础、商业经济基础、商业环境。 |

| AUD(审计及鉴证) |

审计程序、一般公认审计准则及其他鉴证相关准则等知识,及运用于执行委任核查所需技能等。 |

| REG(法律法规) |

道德、公司治理与商法基础:商业与职业道德、伦理冲突、公司治理、美国法律及其他国家法律、合同法、劳动法、企业管理与融资等相关知识。 |

下面我们就四门科目考点分析一下:

Auditing&Attestation审计:单项选择题组(占50%)和模拟案例题组(占50%)4小时

Financial Accounting&Reporting财务会计与报告:单项选择题组(占50%)和模拟案例题组(占50%)4小时

Regulation法规:单项选择题组(占50%)和模拟案例题组(占50%)4小时

Business Environment&Concepts商业环境:单项选择题组(占50%)、模拟案例题组(占35%)和写作题组(15%)4小时

| Section |

Testlet 1 |

Testlet 2 |

Testlet 3 |

Testlet 4 |

Testlet 5 |

| AUD |

36 MCQ |

36 MCQ |

2 TBS |

3 TBS |

3 TBS |

| BEC |

31 MCQ |

31 MCQ |

2 TBS |

2 TBS |

3 WCT |

| FAR |

33 MCQ |

33 MCQ |

2 TBS |

3 TBS |

3 TBS |

| REG |

38 MCQ |

38 MCQ |

2 TBS |

3 TBS |

3 TBS |

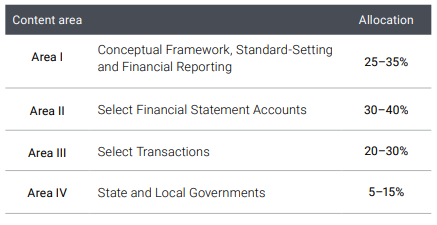

Financial Accounting&Reporting(FAR)

Content area allocation Weight

I.Conceptual Framework,Standard-Setting and Financial Reporting 25–35%

II.Select Financial Statement Accounts 30–40%

III.Select Transactions 20–30%

IV.State and Local Governments 5–15%

FAR Section Blueprint(effective July 1,2019)

FAR Sample Test(practice with the format and functionality of questions from this Exam section)

在页面右边就可以看到免费领取下载USCPA考试资料,里面包含讲义,思维导图,练习题等内容。USCPA资料,戳:

USCPA考前押题+内部讲义【考前必刷】(限时免费领取)

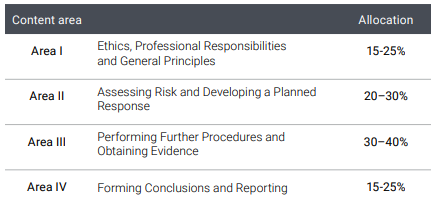

Auditing&Attestation(AUD)

Content area allocation Weight

I.Ethics,Professional Responsibilities and General Principles 15–25%

II.Assessing Risk and Developing a Planned Response 20–30%

III.Performing Further Procedures and Obtaining Evidence 30–40%

IV.Forming Conclusions and Reporting 15–25%

AUD Section Blueprint(effective July 1,2019)

AUD Sample Test(practice with the format and functionality of questions from this Exam section)

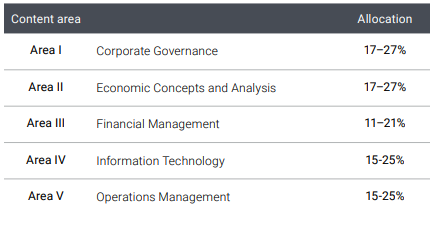

Business Environment and Concepts(BEC)

Content area allocation Weight

I.Corporate Governance 17–27%

II.Economic Concepts and Analysis 17–27%

III.Financial Management 11-21%

IV.Information Technology 15-25%

V.Operations Management 15-25%

BEC Section Blueprint(effective July 1,2019)

BEC Sample Test(practice with the format and functionality of questions from this Exam section)

本视频来源:高顿教育,点击视频右下方按钮可下载至本地进行分享,更多相关资讯请关注高顿教育

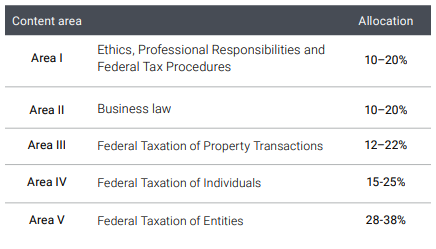

Regulation(REG)

Content area allocation Weight

I.Ethics,Professional Responsibilities and Federal Tax Procedures 10–20%

II.Business Law 10–20%

III.Federal Taxation of Property Transactions 12–22%

IV.Federal Taxation of Individuals 15–25%

V.Federal Taxation of Entities 28–38%

REG Section Blueprint(effective July 1,2019)

REG Sample Test(practice with the format and functionality of questions from this Exam section)

QQ登录

QQ登录 微博登录

微博登录 微信登录

微信登录